Institutional-Grade Trading Indicators

Proven tools used by serious traders. Each indicator is backtested, calibrated for precision, and designed to give you an edge in crypto markets.

Quick Navigation

Swipe to see more categories

Trend-Following Strategies

Robust trend-following strategies for Bitcoin, Ethereum, and Avalanche. Capture major market moves with our proven multi-factor models that adapt to changing conditions.

BTC Strategy

Comprehensive asset selection table for Bitcoin, integrating key performance indicators to highlight optimal trading opportunities.

View on TradingView

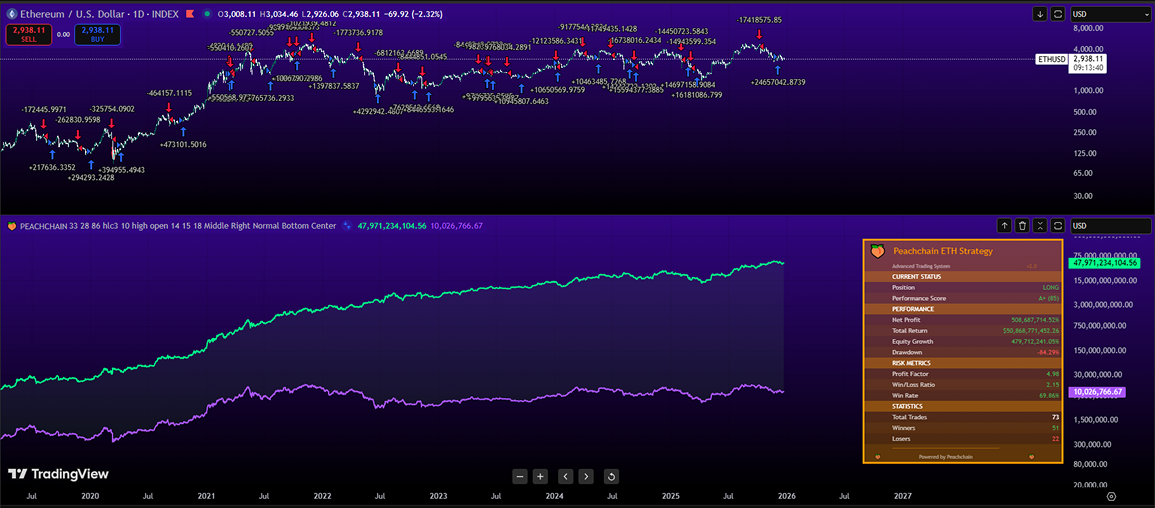

ETH Strategy

Multi-factor selection table for Ethereum, evaluating metrics such as momentum, volatility, and volume to identify prime entry and exit points.

View on TradingView

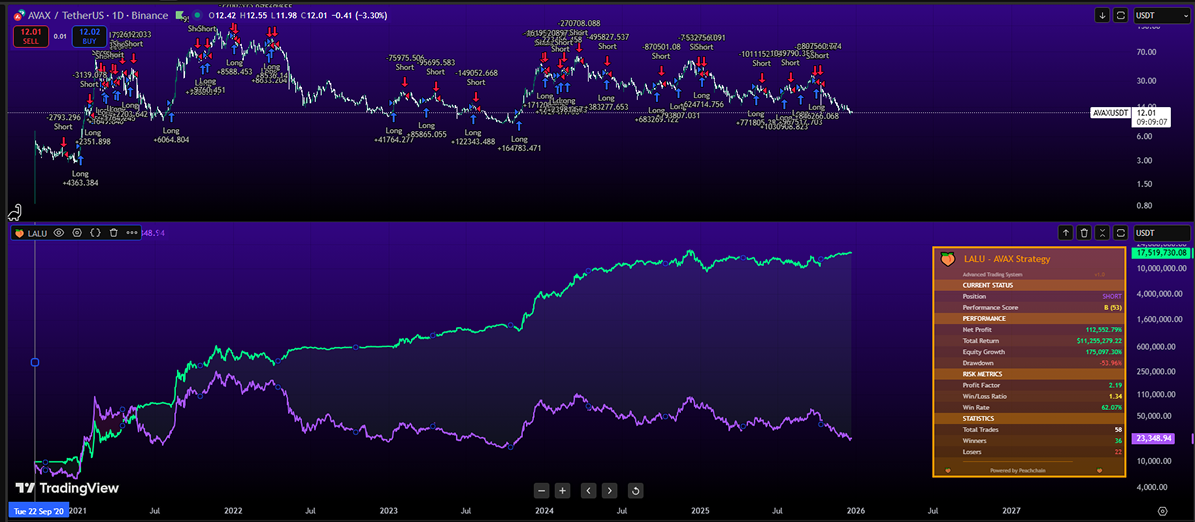

AVAX Strategy

Advanced asset selection table for Avalanche, combining technical and on-chain indicators to guide strategic trading decisions.

View on TradingViewMarket Regime Detection Engine

Dynamic identification of market regimes (bull, bear, sideways) using a blend of technical, on-chain, and macro indicators. Adapt your strategies to prevailing conditions.

Market Regime Detection Engine

Proprietary engine analyzing multiple data sources to classify current market regime and guide strategy adjustments.

Asset Selection Tables

Powerful multi-factor asset scoring systems to rank cryptocurrencies based on momentum, volatility, volume, and other key metrics. Identify top opportunities at a glance.

Asset Allocation system

Comprehensive asset scoring system evaluating cryptocurrencies across multiple dimensions for informed allocation decisions.

View on TradingView

Equity Table Selection

Multi-factor selection table comparing assets side-by-side with key metrics for quick decision-making.

Tournament System

Advanced ranking algorithm that pits assets against each other to determine the strongest performers.

On-Chain Metrics

Deep insights into Bitcoin and Ethereum network health, investor behavior, and market cycles. Our proprietary indicators help you identify optimal entry and exit points.

AVIV MVRV

Advanced Market Value to Realized Value ratio tracking for Bitcoin, identifying overvalued and undervalued zones with precision.

SOPR Analysis

Spent Output Profit Ratio indicator showing whether holders are selling at profit or loss, revealing market sentiment shifts.

OCI Bitcoin

Our proprietary On-Chain Composite Index combining multiple signals for comprehensive Bitcoin valuation assessment.

Valuation Models

Calibrated fair value models for Bitcoin and Ethereum using on-chain data and market metrics. Know when assets are trading above or below intrinsic value.

BTC Valuation

Multi-metric Bitcoin valuation model providing dynamic fair value estimates based on network fundamentals and historical patterns.

ETH Valuation

Ethereum-specific valuation framework accounting for staking, gas fees, and network activity to determine true value.

Global Liquidity Models

Track macro liquidity trends and their correlation with crypto markets. Identify inflection points driven by global central bank policies.

GLI Correlation

Global Liquidity Index correlation with Bitcoin showing the relationship between monetary policy and crypto prices.

Fair Value Heatmap

Visual heatmap showing Bitcoin fair value zones based on lagged global liquidity metrics and historical correlations.

Market Toolkit

Comprehensive market analysis tools including breadth indicators, Open Interest heatmaps, and multi-asset dashboards.

Open Interest Heatmap

Visualize leverage zones and liquidation levels across price ranges to anticipate market moves.

Market Breadth

Track participation across 40+ assets to gauge overall market health and trend strength.

Multi-Strategy Dashboard

Combined view of multiple proprietary strategies (Titan, Protocol, Astraea, Nebulon) for comprehensive market coverage.

Get Early Access to All Indicators

Join the waitlist to get notified when we launch and receive exclusive early-bird pricing.

Early access • Exclusive pricing • Be the first to know